The wheels of justice turn slow, but at least they are still moving. Yesterday, a court in North-Rhine Westphalia, Germany – which has been investigating various parts of the OneCoin empire for several years – convicted three key players for their role in the multi-billion dollar scam. The case – which was complex and involved several delays – started in September 2021.

Dr Ruja, in case you need reminding, remains at large and is still on the FBI’s Ten Most Wanted List

Martin Breidenbach was found guilty of laundering money in connection with the purchase of Dr Ruja’s London penthouses (yes, that’s plural), and sentenced to 2 years 9 months. Frank Ricketts and Manon Hubenthal were both found guilty of providing unauthorised payment services and aiding & abetting fraud, and sentenced to five years and four and a half years respectively.

All three played an important role in Ruja’s empire – especially Ricketts and Breidenbach. The German authorities had been onto the pair even before Dr Ruja disappeared. Breidenbach’s office was raided in September 2017, one month before Ruja vanished. Ricketts’ IMS companies – which moved tens of millions of OneCoin money – were on their radar since 2015.

When you’re making a podcast (or a book) you will often come across suit wearing sub-characters like Ricketts and Breidenbach. They can be important in the mechanics of the scam, but because their role is back-office they rarely get an on-air mention. (This is also because too many names is confusing for listeners). Neither were mentioned in the Missing Cryptoqueen podcast – but I have researched both in some detail.

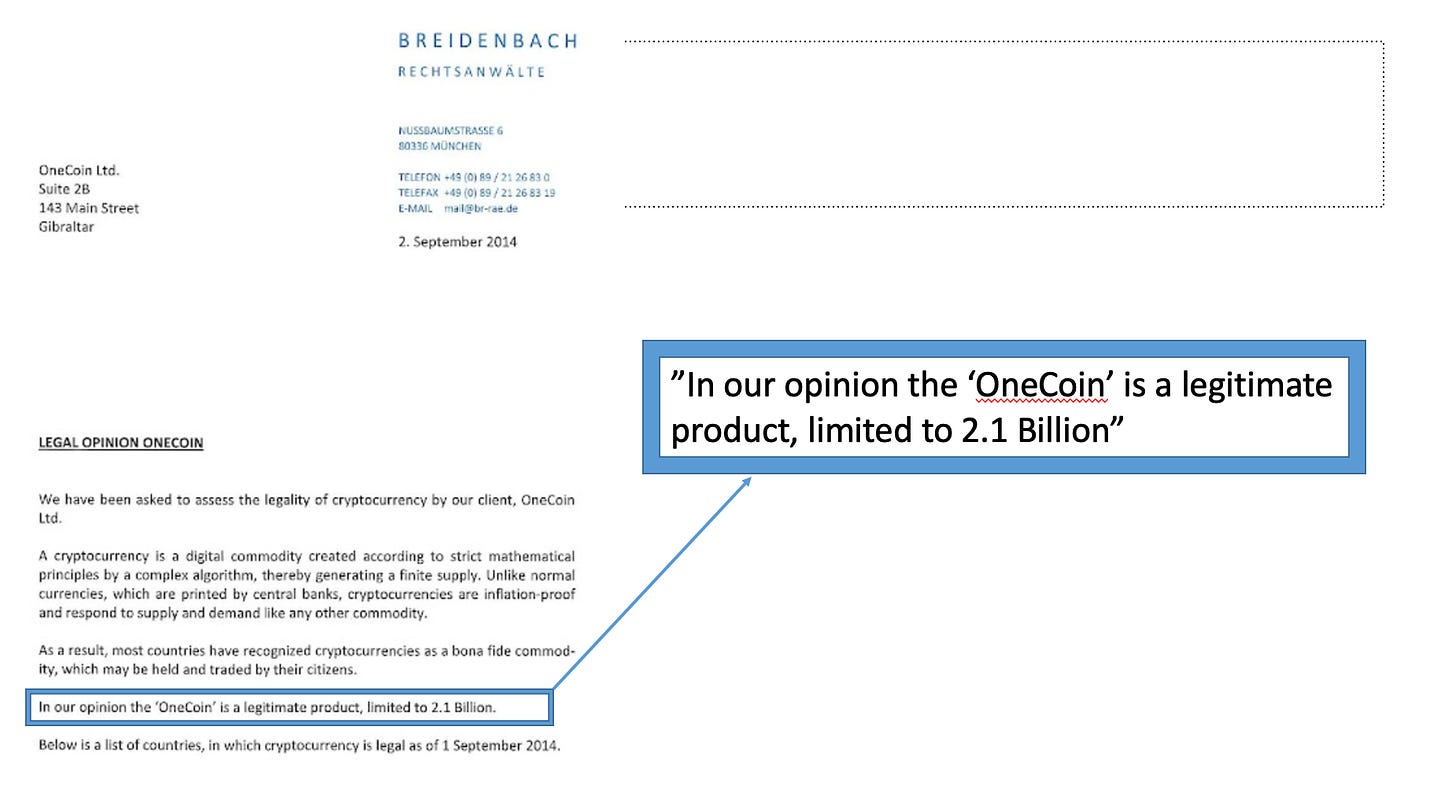

Martin Breidenbach and Ruja went back a long way. He was her authorised defence attorney when she was found guilty (in April 2016) of various counts of embezzlement relating to a factory she’d bought in Waltenhofen years before launching OneCoin. For a while he technically listed as the owner of OneCoin Dubai, and just months after the company was formally launched Martin’s firm Breidenbach Rechtsanwälte published a legal opinion stating OneCoin was ‘a legitimate product limited to 2.1 billion coins’.

Martin’s law firm wrote a ‘legal opinion’ about OneCoin in late 2014, which was widely shared

But it was his involvement in shifting tens of millions of Euros so Ruja could purchase a £13.5 million luxury penthouse in London in 2016 which resulted in the guilty verdict. (I wrote about the penthouse for the BBC here and here, including the fact Ruja was named in 2023 as the ultimate benificial owner of the property).

Ruja’s luxury London apartment, complete with ‘Red Lenin’ by Andy Warhol

Frank Ricketts, meanwhile, ran a company called “IMS”, which provided complex payment and banking solutions for OneCoin.

He also had a long history in multi-level marketing, having worked with Sebastian Greenwood on a previous venture called SiteTalk. (Many of the top leaders in OneCoin had form). After Ruja disappeared, Ricketts temporarily took up the job of CEO of OneCoin, and – ridiculously – sailed onto the stage on a mechanical boat at an event in Thailand. (Ricketts later claimed that he was asked just before event to put ‘motivational and personal development programs together on a global scale as an independent trainer’.)

Frank Ricketts at a OneCoin event in Bangkok, after Dr Ruja vanished

The thing about OneCoin – in fact most scams –is that a lot of key people are quietly forgotten. All the media and policing light is shined at the top leaders and founders. But there is usually a small army of lawyers, PR men, salespeople, formation agents, payment providers, who - sometimes in good faith, sometimes through strategic ignorance or worse - help make the whole thing tick.

For once, the well educated people in suits haven’t got away with it. And now that Breidenbach has been convicted, there is an interesting question about what might happen to the proceeds of any sale of the Kensington penthouse – which is technically a frozen asset. It might, just might, find its way back to UK investors. Stay tuned.

*

In other OneCoin news, I recently stumbled across something slightly strange involving a UK consulting firm. As I’ve written before, Dr Ruja was a genius at brand association. Knowing credibility was critical to her entire operation, Ruja made sure to place herself next to well-known and well-trusted brands, in the hope their glitter might rub off on her. She famously gave a speech hosted by The Economist in 2015, for example, where she gave a platitude filled ‘key note’ speech to a room full of bigwigs. (You can watch it here,)

The video was sent to prospective investors: Look – even the Economist supports me. It didn’t of course. But hapless investors could be forgiven for thinking OneCoin must be legit if the boss gets an invite from The Economist.

There was another, more specialised company, OneCoin was also looking to snag: the secure electronic transaction specialists Consult Hyperion. In early 2017 OneCoin appointed someone to figure out what OneCoin needed to do to fix its growing technology mess. He asked Ruja’s London office, RavenR Capital, to come up with names.

And the name suggested? ‘I would go for Consult Hyperion’ emailed one staffer, attaching a summary of the company. (Gary Gilford, director of RavenR Capital, told me that he wasn’t involved in these discussions).

I know Dave Birch, one of the founders of Consult Hyperion, so I called to him to ask whether RavenR Capital ever got in touch and he told me that they had not. Who knows what they wanted: Dave told me that they do lots of different kinds of due diligence work in payments. He speculated one possible reason they didn’t call: the Consult Hyperion team would have taken about five minutes to notice that something didn’t add up in the supposed world-beating blockchain cryptocurrency scheme. Not that it would have deterred investors of course. Because OneCoin is still being sold around the world right now.

Of course OneCoin never called Consult Hyperion: our integrity and our expertise would have been like kryptonite to them! I couldn't be more proud of our team! As Global Ambassador for Consult Hyperion I will immediately change our slogan to "The People That The Missing Cryptoqueen Did Not Call" !!!

I was tricked into a fraudulent trading bot scheme and lost 600,000 worth of Ethereum. It was one of the worst moments of my life, thinking that all that money was gone for good. But then I discovered BitReclaim.com and decided to contact them.

Their team was quick to respond and very professional. After providing them with all the transaction details, they traced the funds through several wallets and exchanges. They eventually tracked my stolen Ethereum to leveraged outsourced wallets and began the recovery process.

I’ve now successfully detached the first portion of my funds into my Trust Wallet, and I’m waiting on the Ethereum gas fees to complete the rest of the transaction. BitReclaim.com saved me from losing everything.

If you’ve been scammed or had your wallet drained, contact them for help:

Email: bitreclaims@protonmail.com

Phone: +1 310-893-5756

Telegram: @bitreclaims